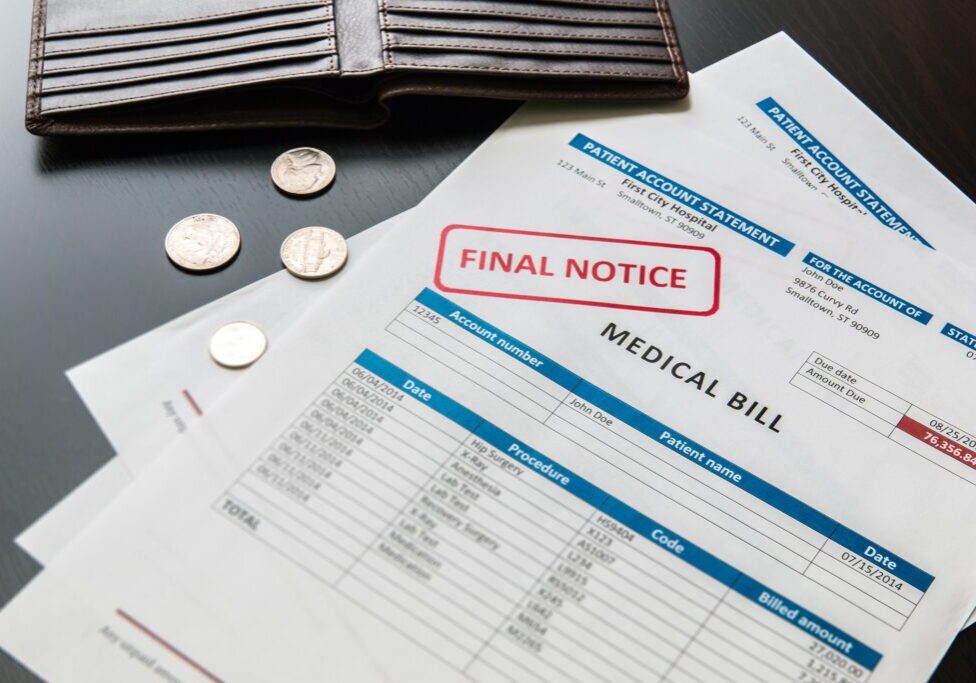

Predatory payday lending drains more than $240 million each year from Louisiana workers by saddling vulnerable borrowers with high-interest loans that they often cannot afford. But instead of working to address this problem, the Legislature is considering a bill that would make it worse.

Senate Bill 365 aims to expand predatory lending in Louisiana by allowing payday and car title lenders to issue “installment loans” with annual interest rates of up to 167 percent. The bill is being pushed by national payday lenders as a way to evade new federal regulations that protect consumers. Similar bills have already been rejected in several other states (Florida being the lone exception).

The payday loan industry markets its products as a solution to short-term financial problems. But the reality is much different. The Consumer Financial Protection Bureau reports that the typical payday customer is stuck in 10 loans per year – many customers take out far more – creating a long-term debt for vulnerable borrowers.

Current law allows payday loans of between $40 and $350, which have to be repaid within 60 days at annual interest rates that often exceed 400 percent. In Louisiana, 79 percent of all payday loans are issued to borrowers on the same day that they paid back a previous loan. Nearly nine in 10 payday customers (87 percent) take out a new loan within 14 days of paying back a previous loan.

Senate Bill 365 would expand this industry by allowing loans of between $500 and $850 for periods of 3 months to 12 months. These new products would be in addition to current payday loans – not a replacement, as the payday industry claims. The payday industry officials backing the bill claim it is needed because of a new rule from the CFPB that aims to stop the debt trap by requiring lenders to ensure that a loan is affordable, so it can be repaid without taking out another loan or defaulting on other expenses.

Here are three things to know about the rule:

- It won’t take effect until August 2019.

- It is highly unlikely to ever take effect at all, as the Trump administration has said it wants it repealed. The industry’s leading trade group just filed suit to stop it.

- Even if the rule does take effect, it should not wipe out the current payday loan industry if lenders are behaving responsibly, as they claim.

If Louisiana lawmakers are serious about protecting consumers from harmful loan product, they should follow the lead of 15 states and the District of Columbia that have capped the annual interest rates that lenders can charge at 36 percent.

Click here for a complete analysis of the bill by the Center for Responsible Lending.

Click here for an overview of the Consumer Financial Protection Bureau rule.