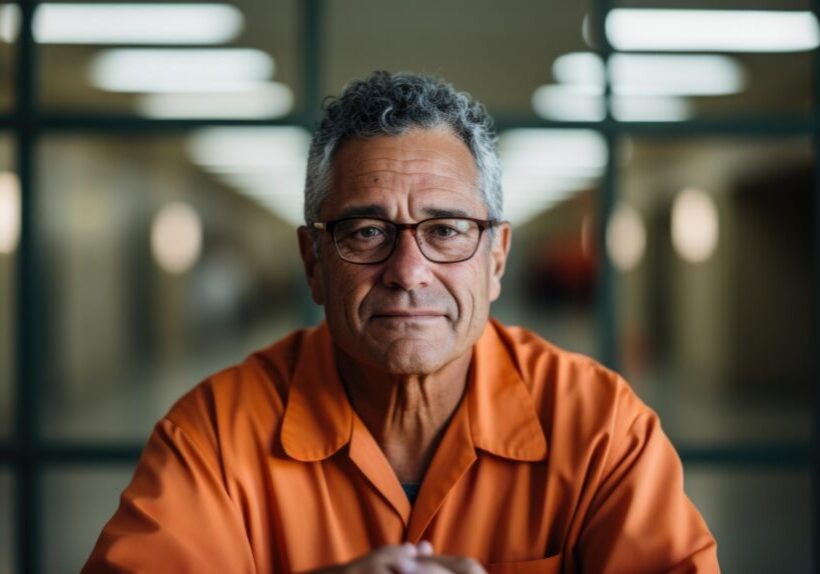

Louisiana has more state prisoners serving time in local jails than any other state in the nation, according to a recently released report from the Bureau of Justice Statistics. As of 2022, 53% of prisoners in state custody were being held in local jails. Verite’s Bobbi-Jeanne Misick explains how the unusual policy is a financial windfall for local sheriffs that can generate millions of dollars in revenue each year.

The growth in the use of local jails happened as Louisiana was under a federal court order to reduce overcrowding in its prisons, as The Times-Picayune reported in its 2012 series “Louisiana Incarcerated.” Instead of building more prisons or reducing incarceration, the state encouraged local sheriffs to build larger facilities. The local parishes are offered a per diem – currently $26.39 – for each prisoner they board, a fraction of the nearly $70-a-day it costs to house people in state prisons.

While the arrangement may be lucrative for local sheriffs, it comes at the expense of prisoners:

Prisoners in jails often have less access to education and treatment for chronic health conditions than their counterparts in state prisons, [Loyola University law professor Andrea Armstrong] she said. … Armstrong said when people serve their sentences in jails – which are designed for short-term pre-trial stays of six months or less – they are often cut off from educational and vocational programs that can help them earn parole. … There’s also evidence that serving time in jail can increase a person’s chance of being locked up again, according to the report.

More states considering wealth taxes

Vermont has joined a growing number of states trying to implement new taxes on their wealthiest residents. Green Mountain State lawmakers are proposing a new tax on capital gains and on people making more than $500,000 per year. The New York Times’ David. W. Chen reports that it’s part of a coordinated effort by progressive organizations aimed at ensuring the wealthiest Americans pay their fair share in taxes.

Called the Tax Justice Initiative, the campaign began in earnest a year ago, when legislators in seven states, including California, New York and Washington, coordinated the introduction of bills mirroring the federal wealth tax proposed by Sen. Elizabeth Warren of Massachusetts during her 2020 presidential campaign.. … (W)hen it comes to taxes, the biggest frustration many Americans have is the sense that the wealthiest aren’t paying their fair share: 82 percent of respondents in an April 2023 Pew Research poll said it bothered them, including 60 percent who said it bothered them “a lot.”

Louisiana’s tax structure – heavy on sales taxes and light on income taxes – is considered the 10th most regressive system in the country, according to new research by the Institute on Taxation and Economic Policy.

An $80 million tax break for nine full-time jobs

Louisiana is handing an $80 million tax break to a Japanese company in exchange for building a chemical plant in Jefferson Parish that will create nine full-time jobs. The Louisiana Illuminator’s Wesley Muller reports that UBE Corp. is taking advantage of Louisiana’s Industrial Tax Exemption program (ITEP), arguably the most generous program of its kind in the country. The tax break won approval from the Jefferson Parish Council, which made a special exception for the company, despite skepticism that the parish won’t see most of the benefits of the deal.

Just prior to Wednesday’s vote, a parish resident notified the council members of a uniformed rubric the parish council, sheriff and school board each adopted back in 2017 that established rules and minimum standards on granting ITEP applications. UBE’s application failed to meet those standards, so the council rescinded the rubric. District 2 Councilman Deano Bonano pointed out that nothing in the ITEP agreement requires the company to bring jobs to Jefferson Parish as opposed to other areas of the state.

A 2016 executive order by Gov. John Bel Edwards gives local authorities a say in whether to forgive property taxes owed by manufacturing corporations. That decision has brought nearly $300 million in new revenue to local governments – money that supports everything from parks and libraries to police and public schools.

Infrastructure “bootcamps”

A new initiative is helping small and mid-sized cities obtain billions of dollars in federal grants to address transportation, infrastructure and other pressing needs. The National League of Cities’ Local Infrastructure Hub hosts a series of bootcamps that helps these communities access funding opportunities available from the Inflation Reduction Act and Infrastructure Investment and Jobs Act. Route Fifty’s Elizabeth Daigneau reports:

The Local Infrastructure Hub kicked off in late 2022 and earlier this month, opened registration for its third round of bootcamps. Each one is tied to a specific grant program. …. A key component in the NLC program is a tool that the group has built to provide census tract level data for cities, delivering insights into various issues, including disparities among residents and which neighborhoods are most underserved. Cities can use this information to help design their grant applications so that they are a good fit with the goals of the federal funding programs.

Number of the Day

15.2% – Percentage share of Louisiana housing units that are owned by single women, the second-highest percentage in the nation. Nationally, single women own more homes than single men. (Source: Lending Tree via Axios)